philadelphia property tax rate 2019

Collection rates for real estate taxes are at an all-time high with on-time payments at 961 percent and a 397 percent reduction in overall delinquent tax debt of all. Tax amount varies by county.

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

If your assessed value went up your property taxes will too.

. The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to. City Council sets a tax rate to be applied to that assessed value along with any policies abatements exemptions etc to affect taxpayers. So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly.

The 8 sales tax rate in Philadelphia consists of 6 Pennsylvania state sales tax and 2 Philadelphia County sales tax. Examine our database of Philadelphia 2019 Property Assessments. 2019 1415 mills on gross receipts and 625 on taxable net income 2020 1415 mills on gross receipts and 620 on taxable net income 2021 1415 mills on gross receipts and 615 on.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property. You go to sections of the Northeast and other sections of. In May 2022 Philadelphia released new assessments of properties and how much they are worth for tax purposes.

What makes Philly unique among its tax-happy peers is that nearly 50 percent of the citys revenue comes from wage taxes currently levied at a rate of around 39 percent. At 200000 a home would see a decrease in its tax bill if its assessed value went up by less than 4. The median value climbed by.

3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any. So in Philadelphia property tax. The current rates for the Realty Transfer Tax are.

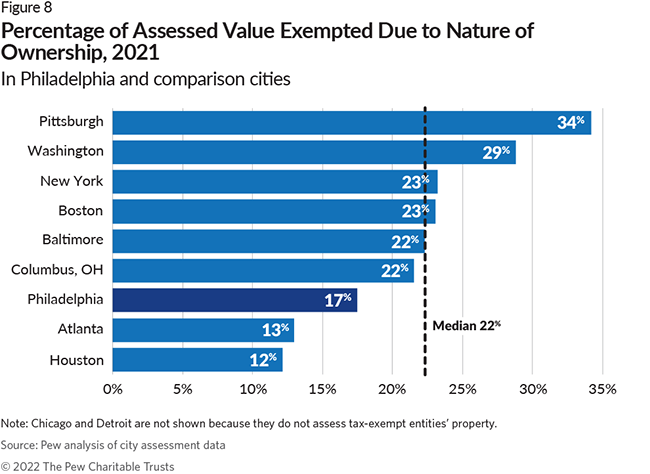

Florida is ranked number twenty three out of the fifty. Philadelphia has a total market value of 134 billion but yields tax revenues on only 91 billion of that property he said. Their combined tax breaks equal about 414 million annually.

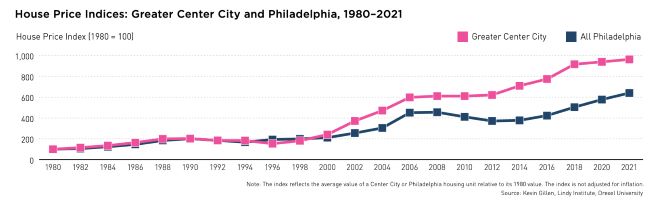

In March 2018 Philadelphia Mayor Jim Kenney announced that he intended to request a 6 percent increase in the real estate tax rate. The median value of a single family home in the city increased 105 in 2019 resulting in tax hikesfor hundreds of thousands of homeowners. For the median valued home which is approximately 128000 a.

Residential Property Taxes Likely By the end of this year Philadelphia City Council with the approval of Mayor Jim Kenney will likely pass into law dramatic changes as to how. The citys current property tax rate is 13998 percent. The median property tax in Florida is 097 of a propertys assesed fair market value as property tax per year.

The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481. According to the 2020 assessments released this month hundreds of thousands of properties will have increases. Philadelphia collects the maximum legal local sales tax.

Later that same month the mayor. But taxes will be going up for most property owners anyway. Tax-exempt properties account for 17 of the citys total real estate value an Inquirer analysis found.

What Is The Philadelphia Property Tax Rate Is It Worth Selling

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

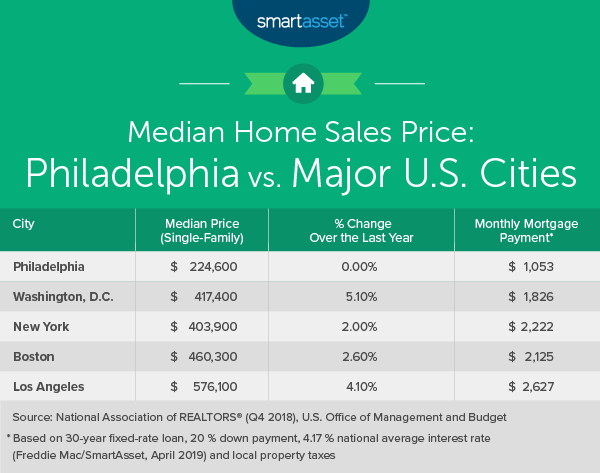

The Cost Of Living In Philadelphia Smartasset

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

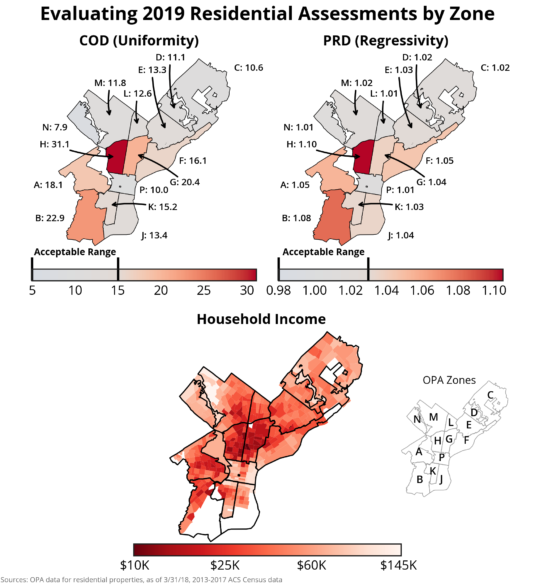

The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Pennsylvania Sales Tax Guide For Businesses

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Economy League Philadelphia Budget Analysis

City Skeptical Of Recent Data For Philadelphia Property Taxes

Philadelphia County Pa Property Tax Search And Records Propertyshark

How Property Is Taxed In Philadelphia The Pew Charitable Trusts